Best Buy Co. is a largest U.S group consumer electronics retailer by revenue. It is a multinational retailer of consumer electronics, home office products, entertainment products and related services. .

In 2006, Best Buy came to China with the acquisition of a Jiangsu Five Star, a Chinese retailer and opened its first Chinese store under its name in Shanghai, soon followed by eight others. With a consumer focused strategy, Best Buy was hoping to capture part of the electronics retailing market, so far dominated by the local retailers Gome and Suning. However, in 2008 the group’s net earnings had decreased by 77 percent from the previous year. No later than February 2011, the MNC announced it would close all nine of its branded stores.

This report analysis the reasons of Best Buy’s failure in China on financial management. This is base on the news on The Wall Street Journal at: http://www.wsj.com/articles/best-buy-to-exit-china-1417678576

News Analysis

Best Buy – Company Overview

Best Buy Co., Inc. (NASDAQ: BBY) together with its subsidiaries is one of the world’s leading companies that operates as a retailer of consumer electronics, entertainment software, home office products, appliances and related services in the United States, Canada, China, Europe and Mexico. It controls retail stores and websites under 11 brand names: Best Buy, Five Star Appliances, Future Shop, Geek Squad, Magnolia Audio Video, The Carphone Warehouse, Best Buy Mobile, Audiovisions, Napster, Pacific Sales and Speakeasy. Best Buy currently has about 165,000 employees worldwide.

Best Buy sells consumer electronics as well as a wide variety of related merchandise, such as computers, computer software, video games, music, DVDs, Blu-ray discs, mobile phones, digital cameras, car stereos, video cameras, as well as home appliances (washing machines, dryers, and refrigerators). Each store also includes a department for audio/visual equipment for automobiles with on-site installation services, as well as a Geek Squad “precinct” for computer repair, warranty service, and accidental service plans.([1])

Recently, Best Buy has reorganized its structure. It divided its business into three regions: America, Europe and Asia. The new business structure makes it easier for Best Buy to share capabilities across the regions easily. This new model can be shared across countries.

Best Buy in China

Why is China?

With such threats on their domestic market, Best Buy decided to double its efforts in foreign markets. With a two digit growth of its middle-class, China represented a promising potential market which the company saw as an opportunity to boost its sales globally. Having operated in China in the past, Best Buy decided to enter the Chinese market in 2006 through the acquisition of Five Star – China’s third largest electronics retailers.

China represented a great opportunity for Best Buy to expand due to economic and social factors. China’s population of 1.3 billion people and an annual GDP (Gross Domestic Product) growth of 10.7%, a strong middle class emerging and which rose from 6.5 million to 80 million whose per capita income surged from RMB 21,739 per household in 2006, representing a “robust 50% increase over 2001 in real terms”.[2]

In 2006, Best Buy entered into an acquisition of 75% of China’s third-largest retailer of appliances and consumer electronics, “Jiangsu Five Star Appliances”. This acquisition provided Best Buy with a strong management team that was familiar with local customers and business models. Moreover, it was an opportunity for the American retailer to increase its knowledge of Chinese customers. Best Buy obtained immediate retail presence in China and enhanced its expansion by opening its first Best Buy-branded store in Shanghai in December 28, 2006.

Exhibit 1: Best Buy – Financial Hilights – 2007

Source: Best Buy’s 2007 Annual Report.

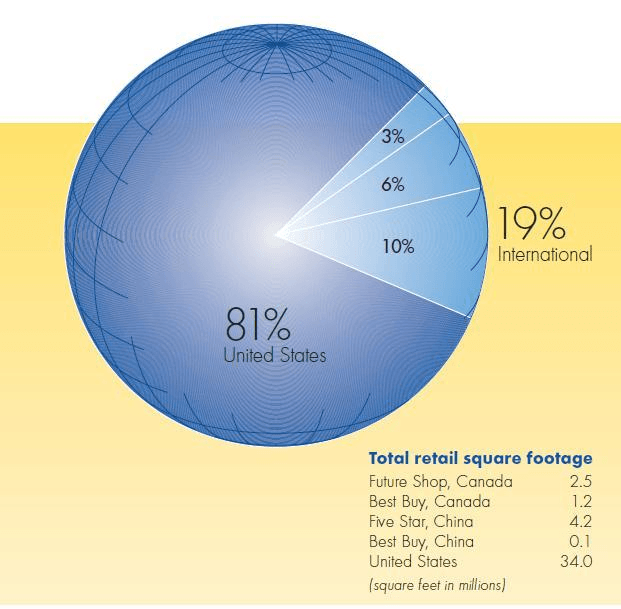

By 2007 Best Buy and Five Star in China occupied 4.3 million retail square feet in China, the equivalent of about 10% of the total retail square footage, operating 135 Five Star stores in seven of China’s 34 provinces and one China Best Buy store in Shanghai.[3]

Exhibit 2: 2007 Best Buy China Total retail square footage

Source: Best Buy’s 2007 Annual Report.

By March 2008 the company operated 160 Five Star stores in China and one Best Buy store which represented 5.9 million retail square feet.

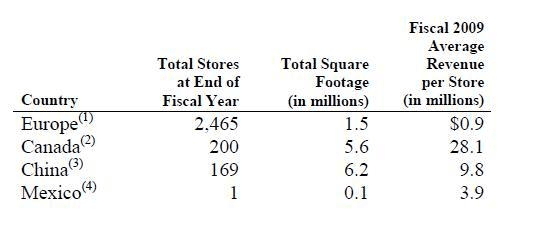

In 2009, Best Buy acquired the remaining 25% of Five Star and converted the Chinese retailer into a “wholly-owned foreign enterprise”, 100% owned by Best Buy. In 2009 the company expanded their Best Buy stores, they operated 169 total stores in China, 164 Five Star stores and 5 Best Buy China stores all located all in Shanghai, and by the end of 2011 the company had a total of 8 Best Buy stores.

Exhibit 3: Total stores 2009 International segment

Source: Best Buy’s 2009 Annual Report.

The unprofitable project

Nevertheless, Best Buy’s strategy in China proved to be unprofitable. In 2008 Best Buy’s international segment’s gross profit rate “decreased by 0.9% of revenue to 20.7% of revenue. Therefore, the company lowered its costs and by 2008, its international segment’s Selling, General & Administrative Expense (SG&A) rate “decreased by 1.3% of revenue to 18.3% of revenue.

Their China operations, which carried a significantly lower SG&A rate than their Canada operations, reduced (their) International segment’s SG&A rate by approximately 0.5% of revenue in fiscal 2008”[4]. Although Best Buy cut significantly cut its expenses in China, results were still not satisfying.

Their China operations, which operated at a significantly lower gross profit rate than their Canada operations, reduced their International segment’s gross profit rate by approximately 0.7% of revenue in fiscal 2008. The remainder of the decrease in their International segment’s gross profit rate was due primarily to the increased sales of lower-margin products in both their Canada and China operations, which was partially offset by rate improvements in certain product categories as well as lower financing costs in Canada”. [5]

In 2010, the company’s international segment operating income resulted primarily from higher operating income in Europe and China.[6] However, during 2010 the company faced a decrease of revenue of 0.3% in China caused primarily by “cost-cutting measures to reduce overhead, payroll and marketing expenses”. Despite these results, the company continued to expand its brand in China, and by the end of 2011 the company had a total of 8 Best Buy stores.

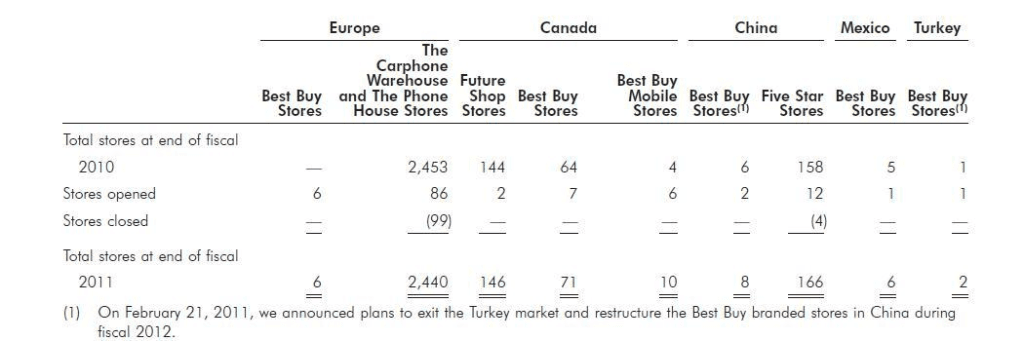

Exhibit 4 :Total Best Buy stores at the end of fiscal 2011

Source: Best Buy’s 2011 Annual Report.

However, in the fourth quarter of fiscal year 2011, Best Buy announced plans to restructure the Best Buy branded stores in China during fiscal 2012. Restructuring activities in China include closing all eight Best Buy branded stores. They also intended to explore other more profitable growth options for the Best Buy brand in China, including the option to reopen two of the closed stores at a later date. All of the eight branded stores were closed by the end of 2011.

Management and operations expenses

Management and operations of Best Buy in China were very similar to the ones in the U.S and Canada. In its 2007 annual report, Best Buy explains that its first store in China “employed an operating model similar to U.S. Best Buy and Canada Best Buy stores.

China Best Buy store staffed with a general manager; assistant managers for operations, merchandising, inventory and sales; Approximately 340 sales associates, including full-time and part-time sales associates. Advertising, merchandise purchasing and pricing, and inventory policies for China Best Buy store were centrally controlled by corporate management. Meetings involving store management and corporate management were held on a regular basis to review operating results and establish future objectives .

Marketing and advertising expenses

One of the biggest challenges for the company when opening a Best Buy-branded store, was their lack of brand equity. On the one hand, Five Star was the third biggest electronics retailer in China. But on the other hand, Best Buy had very little brand recognition in China while Gome and Suning – China’s number one and number two electronics retailers, were widely known of Chinese consumers.

“One of the biggest contributing factors has been establishing brand identity amongst Chinese consumers. Whilst Best Buy is a global retail brand and a particularly formidable force in its domestic US market, it was relatively unheard of in China prior to its acquisition of Jiangsu Five Star. In contrast, both Gome and Suning are household names in China.”

Consequently, Best Buy had to invest significantly in marketing in order to build brand recognition, and ofcourse they had spent a lot of money for PR and marketing.

High flagship stores operating expenses

Unlike Gome and Suning’s strategy, Best Buy primarily opened stores by acquiring the real estate, not renting and leasing. By doing so, the expansion is steady and totally under control, a great advantage for Best Buy to have, but it definitely would slow down the expansion rate and took a great amount of cash flow.

Chinese Protective Barries

China joined WTO from 2002 and the problem is that the WTO and the “most-favored-nation” status are meant to bring along a system or rules for free trade. When China was granted these benefits, however, it has used the rules and standards to boost its own trade, yet has not been following the rules when dealing with other nations. But China reap all the benefits of international organization, but they don’t abide by the rules.

According to a report from MIT Center for International Studies, an estimated 15 to 20 percent of all products made in China are counterfeits, and close to eight percent of China’s GDP comes from counterfeit goods.

Then there’s China’s currency manipulation (its devaluing of the yuan), which gives China a 25 to 40 percent advantage on the U.S. dollar. When Best Buy investing in China, they must be financed out of US dollars to set up store, importing productions. Most expenses incurred in U.S dollars (excluding salaries for Chinese employees and managers ); while revenue mainly by RMB should regularly Best Buy faced with exchange rate risks. If the dollar gained against the RMB is increasing production costs relative to revenue. Also, when the transfer of profits, investors have shifted from foreign currencies into RMB. Conversion Rate is how much at this time? Best Buy really don’t know. It is also implicit exchange rate risk but they cannot do the perfect hedge.

China Consumer Electronics Industry (Industry Barries)

Generally, entry barriers to China’s CE industry are low. Investment in fixed assets is low, allowing retailers to rent or lease real estate rather than purchase it. Also, after China joined the WTO in 2002, this market was fully opened to foreign companies in 2004, with few restrictions to entry. However, there are factors mainly stemming from existing large industry players that prohibit new entrants from entering this market;

1. Regional Oligopoly and Brand Awareness: many large players, such as Gome and Suing, have well-developed brands and formed oligopolies in certain regions, particularly in large cities. A renowned brand usually means reliability for customers, making it more difficult for a new entrant to establish a new brand.

2. Absolute Cost Advantage: Many large chain operators have strong bargaining power with suppliers and efficient management of the supply chain. Therefore, they have absolute cost advantages and can retain profit margins, even during price wars. A new entrant usually does not have such an advantage and is vulnerable to price competition.

3. Location Advantage: the location of stores is closely related to visitor sources, who are potential buyers. With the rapid expansion of large players, the most valuable locations have been dominated by current players, presenting major barriers to new entrants.

4. Good Supplier Relationships: after years of operation, existing players have established long term relationships with suppliers. This gives them certain competitive advantages over new entrants.

Redtape Barries

Open trade didn’t make China more democratic. Rather than China becoming more free and democratic, many U.S. and Western companies have instead bowed to China’s interests, and many others have faced severe economic harm. Many large companies have begun to feel the impact, and many are now pulling out from China. Best Buy now joins other companies that left China, including Google, Home Depot, Metro, Media Market, Adidas, Panasonic, Rakuten, Nestle, and Danone.

Cultural differences – an Evironmental Barries

Because of cultural differences, Best Buy encountered many challenges in China. One is employee relationships. In the U.S., employees rarely work in a hierarchy. However, it is not necessarily the case in China. Understanding the importance of cross culture differences is essential for conducting international business.

For Best Buy, low hierarchy facilitates innovation among employees in U.S., enabling innovation that could earn the company sustainable competitive advantages. How to motivate innovation in a hierarchal society is what Best Buy still needs to figure out. At the same time, Best Buy realized that it is important to know the difference between “form” and “substance”. Forms may change in different cultures, but substance stays the same. For example, substance is the fact that people want to be recognized, and form is that the way those people get recognized. In the U.S., people like to “high five” when they celebrate.

However, in China, it may not work because that is not the usual way that they express happiness. If you ask employees to give Chinese customers a “high five” in the store, both of them may feel awkward and uncomfortable.

Regulatory Barries

As a consequence to this Chinese business model, the sales strategy for Chinese electronics retailers relies highly on commissions as a result sales personnel are keener to sell and meet their quotas in order to increase their personal incomes. This has resulted in higher sales per employee for domestic retailers.

The Chinese electronics retailers’ strategy and organization significantly differs from the typical American Big Box model. Indeed, Chinese retailer usually owns a large store and rent part of it to different brands. For instance, Gome, one of China’s biggest electronics retailers, owns retailing stores in which representatives of electronics brands such as Nokia or LG rent their selling area. Therefore, the Chinese retailers’ revenue includes the rents from the brands as well as a commission on every brand’s profits. Therefore, Chinese retailers are extremely price competitive by passing costs directly to manufacturers.

As opposed to Chinese retailers, Best Buy’s non-commission strategy aimed at building impartiality as a differentiating aspect. Such differences implied costs on Best Buy’s side which its Chinese competitors did not have to bear and thus prevented the multinational from being price competitive.

Many of Best Buy’s products were considered too expensive compared to the local market. Paradoxically, Best Buy’s prices were similar to its main competitors’ – Gome and Suning. However, Chinese consumers positioned Best Buy at a higher perceived price range.

Part of this misinterpretation might be due to the fact that the Best Buy was recognized as a multinational, considered to charge at a higher price. But the main reason why Best Buy’s prices were considered higher relies on the business model itself.

Indeed, Best Buy’s non-commission strategy was accompanied by a fixed-price policy. Therefore, salespersons had no possibility to bargain products whereas Chinese retailers have a more adjustable and aggressive bargaining strategy by which they “lower prices within pre-defined limits if it ensures a sale. This flexible approach allows retailers to price discriminate and maximize revenue from different income groups. Whilst consumer attitudes towards flexible pricing may be negative in North America or Western Europe, it is firmly embedded in the shopping experience in many Asia Pacific markets, especially China

Conclusion

Lessons for those MNCs who want open new subsidiary in China

- Use local knowledge and relevant prior experience.

- Start small. If Best Buy were launching a Chinese strategy now, it would try out smaller, faster, cheaper ideas.

- Work on several fronts. Best Buy – which now owns all of Five Star – will expand its locally branded stores in China. But it will also incubate ideas via the internet, work with local partners and explore other options, such as stores within stores.

- Be different. The success of Apple stores in China, which provide the only reliable outlet for its products, contrasts with Best Buy’s experience.

- Stay humble. NonChinese MNC still seem prone to arrogance about the applicability of their business models that would have embarrassed.

Source

- Beth C. March 29, 2012. Best Buy, The Big-Box Model, And The Trouble With Real Estate. Wired. Retrieved from: www.wired.com

- Best Buy Co., Inc. Funding Universe. Retrieved from: www.fundinguniverse.com

- Patton, L. 2012. Amazon Gained Brand Value at Best Buy’s Loss, Interbrand Says. Bloomberg. Retrieved from: www.bloomberg.com

- Best Buy Co Inc (BBY). Forbes. Retrieved from: www.forbes.com

- Gunther, M. April 11, 2011. Best Buy CEO: Sustainability is all about people. Retrieved from: www. marcgunther.com.

- Best Buy. 2006. Annual Report. Best Buy. Retrieved from www.library.corporate-ir.net

- Best Buy. 2007. Annual Report. Best Buy. Retrieved from www.library.corporate-ir.net

- Ni, V. March 2, 2011. Best Buy’s Withdrawal: American Morals Fail to Transcend Chinese Consumer Market. Retrieved from: www.china-briefing.com

- Rein, S. March 7, 2011. Why Best Buy Failed in China. CNBC. Retrieved from: www.CNBC.com

- Hellstrom, J. December 27, 2006. Best Buy Opens First China Store. The Toronto Star. Retrieved from: www.thestar.com

- Best Buy. 2008. Annual Report. Best Buy. Retrieved from www.library.corporate-ir.net

- Best Buy. 2010. Annual Report. Best Buy. Retrieved from www.library.corporate-ir.net

- Best Buy. 2010. Annual Report. Best Buy. Retrieved from www.library.corporate-ir.net

- Best Buy. 2011. Annual Report. Best Buy. Retrieved from www.library.corporate-ir.net

- Changes Are in Store for China’s Electronics Retailers: Which Model Will Win? May 13, 2009. Knowledge Wharton. Retrieved from: www.knowledgewharton.com.cn

- Best Buy China to Dump Main Brand in Favour of Jiangsu Five Star. March 15, 2011. Euromonitor International. Retrieved from: www.portal.euromonitor.com

- MacLeod, C. February 23, 2011. Best Buy, Home Depot Find China Market a Tough Sell; Big-Box Retailers Retrench After Facing Consumer Resistance. USA Today. Retrieved from: www.usatoday.com

- Dominic Barton, Mapping chinas middle class http://www.mckinsey.com/industries/retail/our-insights/mapping-chinas-middle-class

[1] Best Buy – Wikipedia, the free encyclopedia

[2] Mapping China’s middle class – Dominic Barton (http://www.mckinsey.com/industries/retail/our-insights/mapping-chinas-middle-class)

[3] Best Buy 2007 Annual Report

[4], 5 Best Buy’s 2008 Annual Report

[6] Best Buy 2010 Annual Report

Bài này đã được đọc 7901 lần!